Identity Theft Insurance – Know What You Didn’t Know

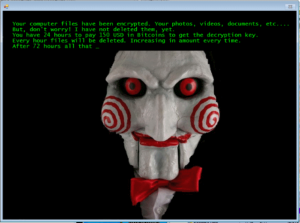

Identity Theft sounds absurd the first time you hear it. Technically it is impossible to steal someone’s identity, but to our horror, this dilemma exists and threatens anyone who uses any type of online financial services. With growing dependence on paper-less methods of doing just about anything, most people want all their information, including the sensitive one, to be on digital devices and cloud storage spaces. These are supposed to be hack-prone safes but once a deviant gets hold of someone’s personal or financial information, they can impersonate them or “steal their identity”.

That’s right fellas, identity theft is happening and hackers actually commit these crimes in order to sneak into people’s credit card and bank account information, insurance claims, etc. without much hassle. It is often extremely difficult for identity theft victims to claim their loss and prove they have been victimized. The reason behind that is the lengthy and tedious process of tracing the source of the hack and then confirming the victim’s claims. Therefore, to help identity theft victims experience as little hassle as possible, Identity Theft Insurance steps in and takes over.

Identity Theft – Rescuing the Victims

Did you know 33% of adults in US have suffered from identity theft and the odds of becoming a victim to such things are increasing.

Gone are the days when people couldn’t wrap their head around the fact there will be a time when something like their identity could be stolen. And look, where do we find ourselves now? Identity theft is a reality that poses a serious threat to those who rely on saving their personal information digitally. However, if we try and look beyond the negativity, identity theft insurance has come forth like a solution too, designated solely to benefit victims of identity theft.

The most common form of identity theft is the leakage of one’s credit card information to a hacker or identity thief. Once a hacker gets hold of the digits on the card, no matter where it is, the owner will be unknowingly sharing his credit card with someone else. Usually, if such a misfortune occurs most credit card companies reimburse you for the loss. However, having an identity theft insurance is going the extra mile in making sure all your loss stands covered.

How Does Identity Theft Insurance Work?

So the question is, how does one get identity theft insurance? Well, for starters, just keep in mind the process of insuring identity theft is not so complicated. Since there is a growing number of identity theft cases and their types every day, buying identity theft insurance is as basic as buying any other insurance. It even works the same way as other types of insurances; there are different packages based on the different types of coverage people look for. The most basic identity theft insurance package entitles you to a consumer fraud specialist who makes sure you get all your money back, along with the guarantee that in the future your data would remain safe from any sort of unsolicited breaches.

Then there are cases where identity thieves go after government-issued identity documents, like passports and social security numbers. The information that is extracted from here, is then used by hackers to get loans or even sign up for mortgages. If your insurance covers for such a loss, not only the case specialist assigned to you will get you all your documents back, but they would reimburse you for any fee or expense that you might have experienced during the process of getting your identity proven.

But the real question is, that is going through the process of getting a specialized insurance worth it? Would you want to spend $25 to $60 just to make sure your financial data is not leaked online? Unlike other incidents like accidents, medical conditions and death, that require insurance, identity theft is relatively easier to avoid. Thus, instead of paying an annual premium for identity theft insurance and carelessly handling your identity data, you can always make sure your data is secure.

How to Avoid Identity Thefts?

Spending a whopping amount on the insurance of your identity may seem kind of unnecessary to many among you, which brings us to another question. Can we keep a check on some things to make sure such situations don’t arise in the first place?

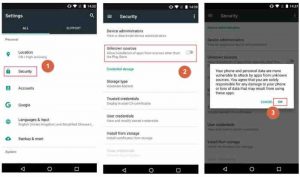

Since financial information is the first thing on the radar of identity thieves, you must keep your credit card bills and bank account information safe; also ensure your loan limit is not too flexible. Furthermore, you need to keep your personal information to yourself. Don’t be careless enough to write it down on sticky notes, since they are most probable to slip into the hands of pesky hackers. And, if you like to keep your information stored in the cloud, make sure to keep your password updated regularly. Every once in a while, remember to check for account logs too. To do this, we would advise you to use a reliable internet connection like one from Spectrum. Spectrum offers a security suite that ensures safe browsing and with Spectrum customer support you can have your internet issues resolved, almost instantly.

All Things Concluded

When it comes to escaping awry identity theft situations, it’s easier and less expensive to be smart and avoid loss on your own rather than giving someone money to help you when you find yourself in a sticky situation. With inflated prices and lengthy processes, it is better to take responsibility of your information, because at the end of the day no one can keep your data safe, better than you. Identity theft is presumably hard to avoid, since attackers carry out such crimes incognito; it all boils down to you – how vigilant you are in terms of keeping your information safe.