The Best Fraud Detection Companies of 2021 Your Business Can Count on to Protect Itself

Even despite all the convenience of credit card usage, there are still security gaps that result in data and money losses, as well as damages to business reputation. According to statistics, credit card fraud is #1 identity theft, and what’s more, it is on especially rise right now because of the pandemic and e-commerce sector rapid growth. That’s why protecting your personal data and finances from intruders with the help of the best fraud detection companies and machine learning in banking solutions offered by them becomes essential. Let’s find out how AI and ML may help on the way.

How Does Card Fraud Happen?

According to the Preventing Credit Card Fraud Through Pattern Recognition research, “As time progresses; the classification of credit card fraud types begins to form, and advanced fraud detection systems are developed to combat the cat and mouse game of credit card fraud. The awareness of the types of credit card fraud is crucial for the understanding of how algorithms detect fraud depending on the fraud type.”

Thus, there are several types of credit card fraud that may occur.

- Card-not-present (CNP) fraud. This is one of the most frequent types of credit card fraud since it doesn’t require the plastic card to be present. Card credentials and some personal information are enough to illegally use the card online.

- Counterfeit and skimming fraud. This approach refers to intercepting credit card details near the ATM or POS terminal.

- Lost and stolen card fraud. This is a very old fraud method that allows for using unprotected credit cards that were lost or stolen until they will be blocked by the owner or run out of money.

- Card-never arrived-fraud. Since most of the credit cards are still delivered by traditional mail, they may be stolen or intercepted before they arrive.

- False application fraud. This is one more widespread type of fraud. It happens when somebody uses your personal information to obtain a loan. As usual, such loans may be obtained from “loan sharks” companies that don’t care about the identity and real solvency of the borrower, and use illegal practices to get the loan back instead, while making the victim pay enormous interest rates.

How Does Machine Learning Detect Fraud?

Fortunately, machine learning is able to deal with most of the types of fraud we have described above. Smart systems work through a careful and immediate analysis of data, which allows them to find invisible anomalies, changed patterns, and make accurate inferences about whether a transaction is legitimate or fraudulent.

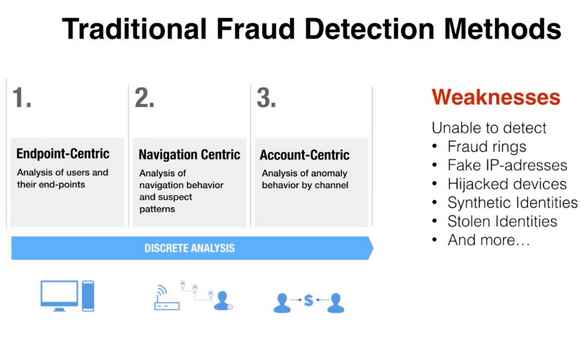

Compared to outdated defense methods, machine learning and artificial intelligence in banking offer a new and more competent approach.

AI/ML Fraud Detection vs Old Approaches

- Machine learning in banking is fast. Machine learning works in real-time, in contrast to outdated financial protection methods, which made it possible to detect fraudulent transactions after they had taken place.

- Artificial intelligence in banking is efficient. Because of the AI’s ability to deal with data in real-time and prevent fraudulent attempts, it becomes an efficient and money-saving tool for financial companies and their customers.

- The best fraud detection companies are secure. AI solutions provided by the best fraud detection companies have a high level of security and are carefully tailored to the specific business needs.

What Are the Best Credit Card Fraud Detection Techniques with AI and ML?

Despite the fact that the usage of artificial intelligence and machine learning in banking may be explained quite simply, there are still purely technical credit card fraud detection techniques that ensure a machine learning system work seamlessly and do its job well.

- Naïve Bayes (NB). This technique is based on the theory of probability and the maximum likelihood estimation of a certain probability. The advantage of this model is that it does not need a lot of data to train efficiently enough and evaluate events with a high degree of accuracy.

- Support Vector Machines (SVM). It is a supervised machine learning model that is used for classification and regression analysis.

- K-Nearest Neighbor algorithms (KNN). This is one more technique that is used for classification and regression analysis.

How Can You Prevent Credit Card Fraud?

Of course, it is almost impossible to protect your business 100% since anti-fraud protection will always resemble a game of cat and mouse. That is, the more secure the solution you use, the more the hackers will make an effort to break through your line of defense. However, there are a number of rules that still apply.

- Make sure all of your employees understand the importance of protecting your business from fraudulent intrusion. In 2021, insider attacks and hacking of devices that employees use to work from home are one of the cybersecurity trends.

- Use a bank fraud detection machine learning solution as most fraud transactions can be stopped at the intent stage.

- Be especially careful during critical loads on your website, for example, during the holidays or sales, as fraudsters use these opportunities, realizing that the business may not have enough resources to control all transactions without exception.

The Best Fraud Detection Companies

However, efficient fraud detection with AI and machine learning for banking and eCommerce will not be possible without the top-notch anti-fraud software provided by the market-leading companies below.

- ClearSale. This is a top-notch software aimed at providing merchants with ultimate protection against fraudulent transactions and chargebacks that may be suitable to small and enterprise-level businesses as well.

- Signifyd. The solution provided by this company is aimed at ensuring payment compliance, revenue protection, and abuse prevention.

- Riskified. This is not only a credit card fraud prevention solution. This is also an outstanding tool for improving the eCommerce sales funnel, leads capturing, and turning them into loyal customers. Risk prevention is one of the main goals of the software.

- Kount.This application is used by more than 9000+ companies worldwide and it significantly helped them reduce chargebacks, prevent friendly fraud and account takeover, as well as stay protected from other types of online scams.

Conclusion

Thus, there are a lot of good fraud detection companies that may provide you with high-class software for preventing any fraudulent activities, protecting your data and finances, and strengthening your reputation on the market. However, not all of them may be tailored to the specifics of your business as the custom anti-fraud solution may. Considering the anti-fraud protection relevance, using some of the AI-powered applications above or creating your own protective software from scratch becomes essential. SPD Group has vast experience in ML and AI development and always prioritize your data and money safety so you are welcome to get in touch and get more actionable insights on the ways to improve your anti-fraud protection.