How AI Analyzes Financial Markets

Financial market businesses are actively innovating and differentiating themselves in order to stay competitive and get a larger percentage of assets. A learning machine stock market may assist businesses in rethinking their operations, from artificial intelligence trading to artificial intelligence fraud detection. For trading companies, this means not just competing, but also winning via the use of their own data and the provision of bottom-line results.

Accurate data analysis and the successful use of artificial intelligence in the stock market are required for efficient asset management. To be successful in any financial industry, you’ll need to put in a lot of effort and make extensive use of artificial intelligence (AI). Artificial intelligence is used in the development of modern-day stock trading software.

What and who are the most significant market influencers at any particular point in time? What are people’s opinions on a new business product from the Dow Jones Industrial Average (DJIA)? In order to respond to these queries and predict market movements, it is feasible to make – or save – millions of dollars by using artificial intelligence (AI) and deep learning.

Before making investment decisions, hedge funds, banks, and brokerage firms all do comprehensive data research on their own portfolios. Data assets that are used to get insight into the investing process may be expensive and time demanding, particularly if they are referred to as “alternative data,” which refers to these data assets that are not often used. As a consequence of alternative data, a new industry has sprung up where information is gathered, sifted, and then sold to trading companies to make money. For the investing community, data analysis optimization (as well as financial forecasting as a result) has become critical, and the application of artificial intelligence in finance and artificial intelligence in trading has emerged as a genuine cure for artificial intelligence predictions of market movements. Without a doubt, artificial intelligence stock and Forex trading software will have a major impact on the stock market. The applications of artificial intelligence are almost limitless. One of the examples of this is the currency market, where FX traders frequently use Forex robot trading apps, in order to forecast future price changes in the marketplace. It’s already had an impact on virtually every area of our lives, including our work. It allows us to get real-time feedback from companies, eliminates human error and automates the bulk of our daily activities, and improves the photos we take with our smartphones, among other things.

Each day, according to various sources, the stock market is worth up to $5.3 trillion in value. When it comes to trading on margin, there are many advantages for traders, including cheap costs, excellent liquidity, ease of entry, and a diverse selection of trading pairs. In order to get the most out of your forex investments, you must be aware of both the risks and the rewards of trading in the foreign currency exchange market. One of the major disadvantages of complicated price-setting systems is that they are prone to high volatility and risk.

Artificial intelligence is used by traders to minimize the probability of failure. According to statistics, trading robots are used by 90 percent of successful forex traders nowadays. They will be able to swiftly and simply analyze huge amounts of data, keep track of their performance in real-time, and enhance trade efficiency in the future as a result of the use of this cutting-edge technology.

Advantages of Using AI

Machine Learning and predictive analytics are two key advantages of integrating AI into the FX market.

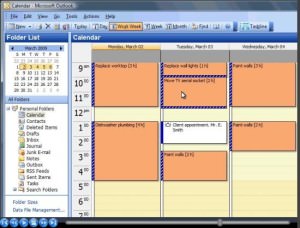

To anticipate market swings, predictive analytics makes use of historical trading data and algorithms. Predictive analytics extends human skills by analyzing large volumes of data more quickly and with fewer errors. Traders may spend more time developing data-backed trading methods instead of worrying about relying on AI technologies to make predictions for them.

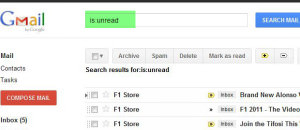

FX traders do their research, gather data, and create a trading strategy across a variety of devices and platforms. 35 percent of forex traders said they use their cellphones to find and compare FX brokers, according to the same research. Mobile trade is projected to increase from 18% to 37% over the next five years, which is not unexpected.

Because of these startling statistics, it comes as no surprise that more FX firms are joining on the mobile trading bandwagon. To reach the appropriate customers, forex brokers must spend more on mobile marketing.

More than anything else, they must provide tech-savvy traders a user-centric experience that includes multi-channel onboarding, a responsive mobile app, as well as streamlined deposit and withdrawal procedures for their accounts.

Many forex traders believe that better trading choices and higher profits would be possible if they had access to more data before trading.

Unfortunately, things aren’t quite as cut and dried as that.

For traders, one of the most difficult challenges is not knowing how to gather data or comprehending what kind of data is important to them. Most critically, they’re unsure of how to make strategic use of the data they’ve accumulated.

That’s why their trading approach may suffer since they begin to place too much reliance on irrelevant or incorrect information.