10 Best Apps Like Dave to Get Cash Advances Easily – 2024

If you have ever used Dave, you may know it is a reliable app that gives easy cash advances. But it is not only a single app of its own. You can find many apps like it with some decent work processes and the same reliability. Such apps provide both small cases and big personal goals.

In this article, we have gathered all the best apps which are available on Android and IOS. You can download them to claim the money. Before starting the details, though we have done our investigations for these apps, remember that it is necessary to do personal research about the features available before using these apps. Now without any further ado, let’s get into the topic;

How Does Dave Like Pay Check Apps Work?

The Dave-like apps work by giving you a part of your next month’s salary earlier than the official payday. You can use these apps for situations in which you badly need money. These paycheck apps can give you an advance salary of up to $100-$200. Whatever amount you borrow will be deducted from your salary for the next month.

Since the money these apps give you is your cash which is still not given to you, some of them don’t demand much interest from you. However, you still have to pay their membership fees of around $1-$10, so they can provide consistent services.

Dave is a pioneer app in the paycheck market. It has amazing other features for which it only charges $1 monthly. The Dave users are always satisfied with its work. However, you can avail of the same pay advance service from the following mentioned apps.

List of Dave Alternative Apps to Get Cash Advance

| S.No | App Like Dave | S.No. | App Like Dave |

| 1 | Brigit | 6 | Empower |

| 2 | Earnin | 7 | Axos Bank |

| 3 | MoneyLion | 8 | DailyPay |

| 4 | Branch | 9 | Chime |

| 5 | Even | 10 | PayActiv |

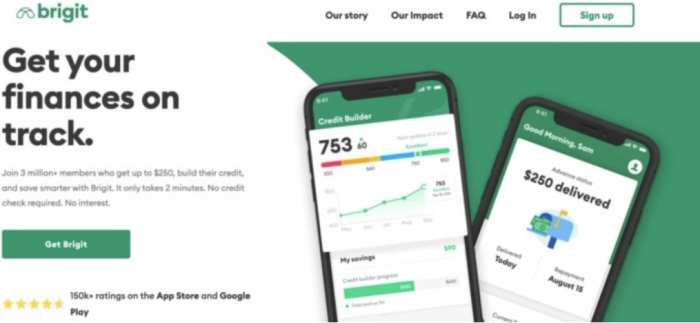

1. Brigit

Brigit gives you excellent services like Dave. You can claim advance payments of up to $250 from it. The Brigit app has a pay monitoring tool which you can use it to manage your budget and analyse your salary.

Because of the quality service and the great app, you must pay a monthly $9.99 membership fee. Many find the price as too much, since Dave only charges $1.

Benefits of Brigit:

Birgit is a consistent app that gives you the following benefits;

- It is linked with 15,000+ US banks. The widely used banks, like Wells Fargo, TD Bank, Chase, and Bank of America, are also included.

- It can save the extra charges of over-drafting and automatically transfer the salary into your account when you have a low balance.

- All the information is well-protected and safe.

- It gives you an advance payment of $250.

- It has a budgeting tool and a monitoring tool for free.

Drawbacks of Birgit:

Despite having a lot of benefits, it has a drawback which is as follows;

- You must pay a big chunk of money monthly as a membership fee.

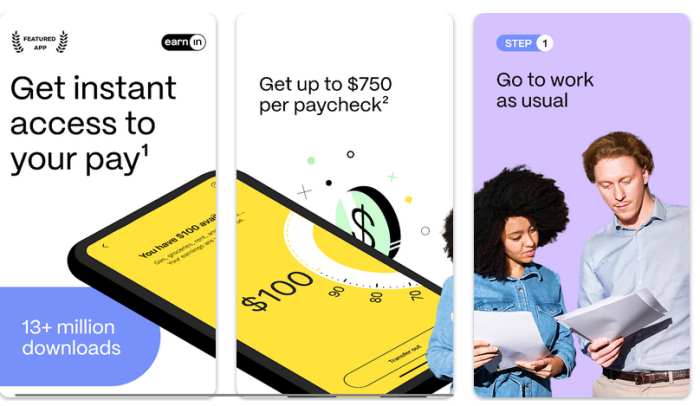

2. Earnin

Earnin or ActivHours doesn’t charge a monthly membership fee. However, you can tip the app whatever amount you want as service charges. You can claim $100 off your salary on this app.

Benefits of Earnin:

You can get the following benefits from this app;

- It has a balance sheet alert on its apps which notifies you in case of dropping cash in your account.

- It transfers $100 into your account to avoid additional overdrafts fee.

- No membership fee

Drawbacks of Earnin:

Earnin also has some drawbacks, which are as follows;

- It requires a physical location of your workplace.

- It also demands a regular pay schedule which may be weekly, monthly, or yearly.

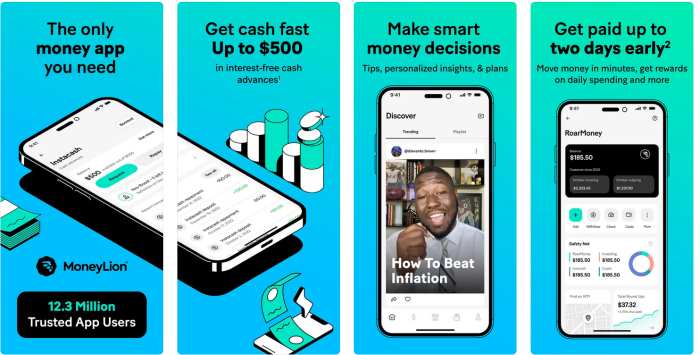

3. MoneyLion

MoneyLion has four features in just one app. It lets you take cash, invest, save, and provides further investment options together. You can borrow up to $250 immediately using its Instacash features.

Benefits of MoneyLion:

The moneyLion app gives you the following advantages;

- It charges only a $1 monthly subscription fee.

- Unique banking app with all four features.

- It doesn’t require any threshold amount.

- Easily transfer money into your investment accounts.

Drawbacks of MoneyLion:

You can consider another app because of its following drawbacks;

- It charges a huge amount of $20 for its Credit Builder Plus.

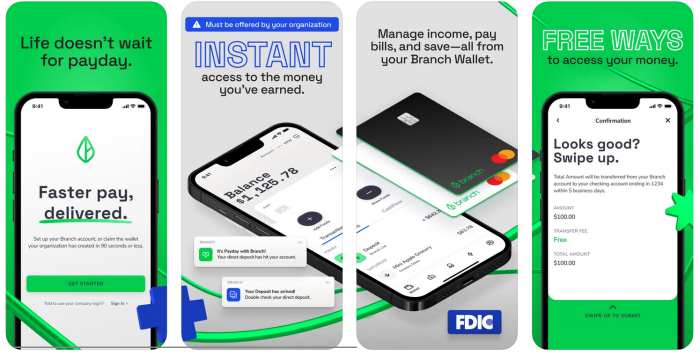

4. Branch

The branch app is available in other countries, including the US. You can borrow cash advances up to $150 daily or $500 as a paycheck. It offers not only advance pay but also a debit card, transfer funds, and bill payment facilities.

Benefits of Branch:

You can use the branch app for its following advantages;

- You will get free of cost ATM service in 400,000+ locations.

- No charges for standard paychecks.

- It charges only $2.99 to $4.99 for instant debit card advances.

Drawbacks of Branch:

The branch app does have a few drawbacks, which are as follows;

- A lengthy process for cash advance facility.

- Too high-interest rate, approx 360%, in a few locations.

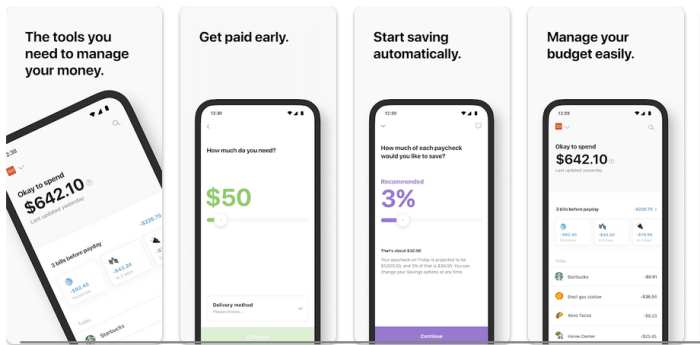

5. Even

Even is a decent competitor of the Dave app. It offers interest-free advance pay and lets you get a paycheck from multiple employers in a partnership with Even. A useful notification feature also sends you updates about bill payments and money transfers.

Benefits of Even:

You get the following advantages from Even;

- A vast of 18,000 banks are connected to it.

- Interest-free advance pays.

- It gives you a budgeting feature.

Drawbacks of the Event:

It even has a few drawbacks, which are as follows;

- You have to pay $8 membership charges.

6. Empower

Empower is also a great option for advance paychecks as it is interest-free and gives you an advance payment of $250. It will only charge $3 as a fee and implement no late charges. Apart from the positive points, it requires a regular deposit to be eligible and charges an $8 membership fee.

Benefits of Empower:

Empower gives you the below-mentioned benefits;

- It gives you 10% cashback on partnered restaurants, groceries, and shopping.

- It takes no interest and has a budgeting feature.

- Guide you to spend according to your salary.

Drawbacks of Empower:

You can avoid Empower because;

- They charge an $8 membership fee.

- It requires regular deposits.

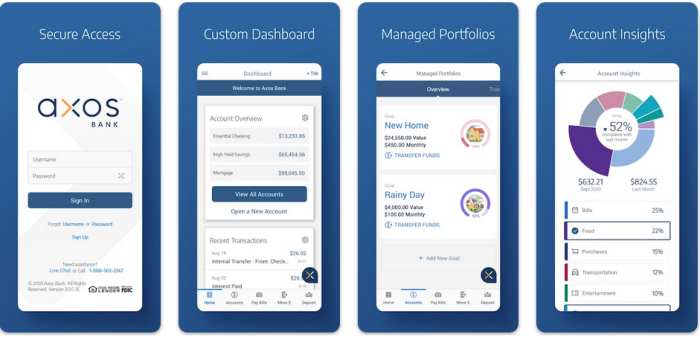

7. Axos Bank

Axos is not only an advanced paycheck app; instead, it gives you multiple options for investment, loans, and personal finance management. It has a unique Direct Deposit Express through which you can get your payment two days before the employer deposits.

Moreover, it doesn’t charge any membership; you can make your Axos account with $50. Axos also focuses on security. It requires fingerprints, Two factors authentication, and face IDs to give you an ultimate safe banking experience.

Benefits of Axos:

Axos is one of the fine replacements for the Dave app, which gives you the following benefits;

- No membership or overdraft fee.

- Just deposit $50 for account opening

- Two days early access to your paycheck.

- Its security features give secure banking.

Drawbacks of Axos:

Axos gives an ultimate banking experience with many security advantages and decent services. However, you can consider the below point as a disadvantage;

- You must have to deposit $50 to open an Axos account.

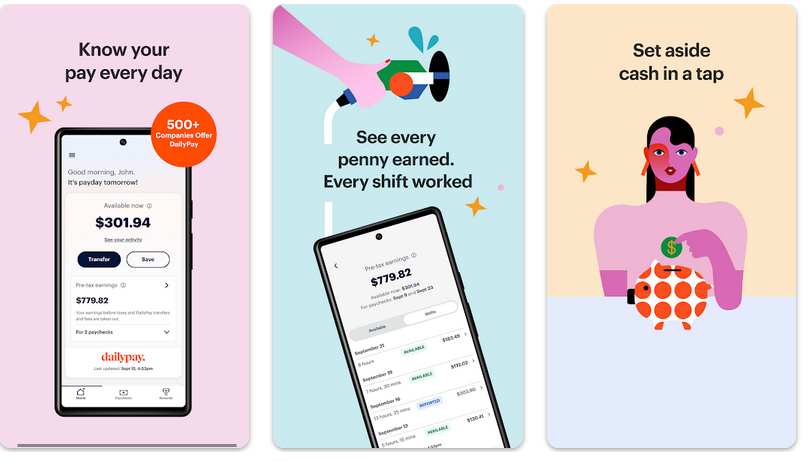

8. DailyPay

DailyPay gives you early access to your paycheck if your employer is partnering with it. And your next month’s pay can be transferred to your account before that month. To avail of this service, you have to pay $2.99 as service charges.

Benefits of DailyPay:

DailyPay is one of the best apps on this list because of its following benefits;

- Early Access to Pay

- 256-bit level encrypted, PCI compliant, and SOC 2 audited.

Drawbacks of DailyPay:

Despite its decent features, it has a drawback;

- You can only get paid if your employer supports it.

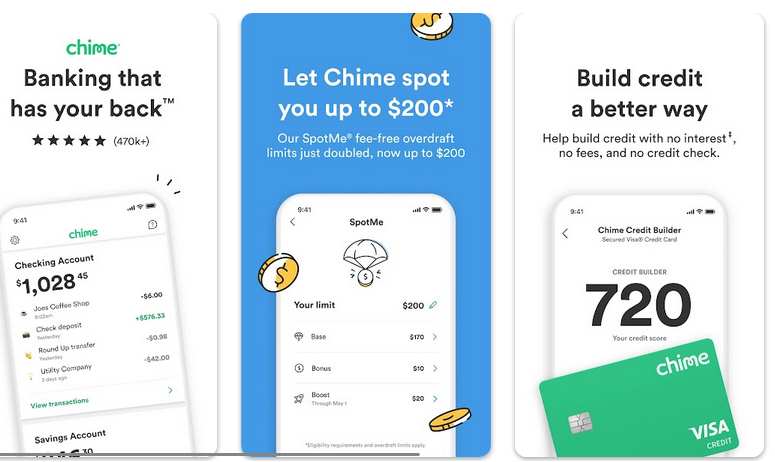

9. Chime

Chime also gives you access to salary two days before, similar to other apps on this list. You can claim a $200 amount from it. Additionally, it charges nothing from you. All services include monthly maintenance, transaction, and minimum balance fees. This app can also be used for transfers and withdrawals from 38,000 US Atms.

Benefits of Chime:

Among all the advance paycheck apps, Chime stands out because of the following benefits;

- It deducts no charges.

- A unique “Spot me” feature to borrow $200 at once.

- Two days early access to the wage.

Drawbacks of Chime:

Regardless of the quality features, there are a few disadvantages of Chime; these are;

- You have to pay to atm draw if you’re not using the partnered atm.

- You must have to receive $500 to use the Spot Me feature.

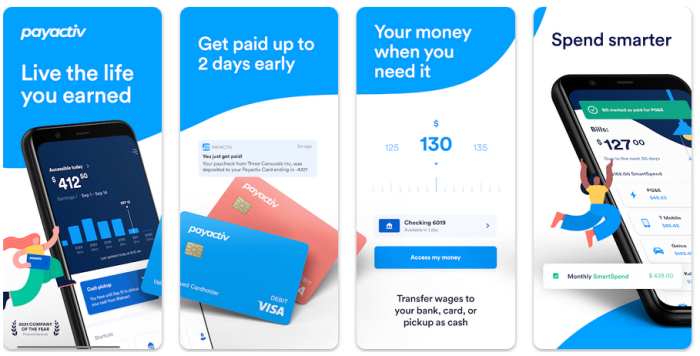

10. PayActiv

PayActiv gives early access to their wage for only the users whose employers are partnered with it, but you can also use it if your company is not registered with it by PlayActiv card. In this case, you can enjoy your pay two days before.

It also displays your savings on the app so you may know them. You can also transfer your money from this app to your bank account.

Benefits of PayActiv:

You should go with PayActiv app because of its following benefits;

- Free of-cost service

- It can give some beneficial saving tips.

- Many prominent enterprises are partnered, like Pizza hut, Walmart, Uber, Hilton, etc.

Drawbacks of PayActiv:

Some cons of PayActiv are;

- Its app is messy.

- Can you incorrect financial advises.

Conclusion:

Dave, like apps, are amazing as they let you use your salary in advance. You can even take a loan from these apps. Apart from their exciting features, they are limited to giving you a limited chunk of money. You can maximum get access to $500, not other than this.

Once you start using these apps, you will struggle to get access as the process may be lengthy or complicated. Many users prefer to remain stuck to Dave. However, many have started using other apps from the list at their convenience.