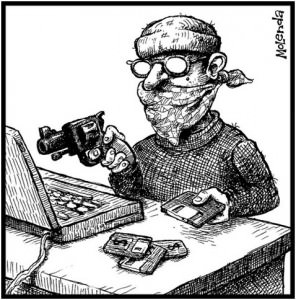

Better Consumer Safety For Online Transactions Is Key To Identity Theft Protection

As the world shifted into the technological warp-speed with the coming of accessible internet and devices, fraud and identity theft also reared its ugly head. The problems, off-late has risen to such an extent that Google, social media platforms, iOS, and Android devices and everyone in between are ramping up the security protocols.

It is interesting to note that it’s not just the consumers who are at an elevated risk of fraud and identity theft. Data breaches are a common enough occurrence for major retailers as well. There are fraudulent business concerns as well as phishing email links and texts that steal your personal information directly from your devices at home or the workspace.

However, since the demand for online protection arose, several services have cropped up with protection features, applications, and third-party software that discourage spammers and phishers from hacking personal details. These applications work for individuals as well as organizations. You can try out Identity Guard free trial if fraudulent activity issues plague you. The trails are a great way to get a hang of the software or application.

For a business concern, such services are extremely beneficial as it allows for the casting of a much bigger protection net, safeguarding multiple accounts and workstations. A company-wide security plan is what is essential, and most of the firms with dedicated IT departments are working double time for protecting sensitive data.

Here are some tips from experts that allow you to safeguard your online activities and transactions.

Financial data is always separate

You must do any sort of banking activity on a dedicated workstation. This means you shouldn’t use your personal laptop or phone for any banking facility or transactions. If you are in the habit of recycling devices, then make sure to wipe clean the hard-drive before putting it to use. Always back up all financial data, information, ID, and passcodes on a separate “air-gapped” device under lock and key.

Always enquire before answering queries

Here is what you need to remember regarding banks; these financial institutions, as a general rule of thumb, never ask for personal data over the phone, texts, or emails. Therefore, never provide any caller or link with all the necessary details regarding your financial dealings. This is true for your PINs, security and tax IDs, account details, social security, passcodes, and OTPs.

If you have to communicate details with a bank official, make sure to enquire with the bank before going ahead. Make sure that you are on a secure channel when supplying the details; usually, the official app or the banking platform. Also, understand that several email phishing schemes look like authentic sellers, vendors, and suppliers. Always verify the source before clicking on any link forwarded to you through emails and text messages.

Passwords are secrets

Password sharing is a strict no. Never keep any documents or cards lying around that might have your passwords or financial data. It is essential to keep changing the passwords regularly to avoid phishing and brute-force hacks. If you are working on a shared network, make sure that the SSID and pass-codes are changed every day. Always avoid broadcasting SSID and use standard encryption protocols for all networks and devices.

More on phishing

Phishing is the very act of sending you a prompt that compels you to click so that changes to your account can be performed remotely. At the very least, you will be asked to make changes to your passcodes and details, which will get recorded and sent to a remote device, usually the point of origin for the phishing link.

Several links can even install spyware to record keystrokes to create a data map of the day or ransomware to lock you out of your device. So, think twice before clicking on a mail link from an untrusted/unknown source.

Device protection

To protect your devices, whether it’s Android, Windows, or Mac – antivirus software is crucial amid increasing cyber-attacks. These third-party applications do not come cheap, but it is a necessary one-time investment. You can also secure multiple devices, at least three, with the same copy of the antivirus.

Regularly update your devices, from laptops to handhelds, as security patches are released consistently, keeping in mind the most advanced threats. Most antivirus software runs are anti-spyware/malware as well. If not, you will need a separate application. These will filter suspicious and junk texts and emails from entering your devices.

Also, keep in mind that the firewall is a vital barrier that doesn’t allow malicious software, trojan files, and malware to get installed in the device. So, keep it up and running at all times. It is a great practice to update the browser to the latest edition since the security protocols will get boosted.

Follow these easy practices to boost your online and banking device security.